The debt snowball chapter 4 lesson 6 – Embarking on the Debt Snowball Chapter 4, Lesson 6, this exploration delves into the intricacies of the Debt Snowball Method, a powerful strategy for conquering debt and achieving financial freedom.

This lesson provides a comprehensive overview of the Debt Snowball Method, guiding you through the process of identifying, prioritizing, and repaying your debts. By following the principles Artikeld in this chapter, you can effectively manage your finances, reduce your debt burden, and pave the way for a brighter financial future.

Overview of the Debt Snowball Method

The debt snowball method is a debt repayment strategy that involves paying off debts in order of smallest to largest balance, regardless of interest rate. The goal of the debt snowball method is to build momentum and motivation by quickly paying off small debts, which can help individuals stay on track and avoid feeling overwhelmed by debt.The

debt snowball method works by first listing all debts from smallest to largest balance. Individuals then make minimum payments on all debts except the smallest one, which they focus on paying off as quickly as possible. Once the smallest debt is paid off, individuals move on to the next smallest debt and repeat the process until all debts are paid off.There

are several benefits to using the debt snowball method. First, it can help individuals build momentum and motivation by quickly paying off small debts. This can be especially helpful for individuals who are struggling to stay on track with their debt repayment plan.

Second, the debt snowball method can help individuals save money on interest charges. By paying off debts with higher interest rates first, individuals can reduce the amount of interest they pay over time.However, there are also some disadvantages to using the debt snowball method.

First, it can take longer to pay off all debts than other debt repayment strategies, such as the debt avalanche method. Second, the debt snowball method can result in paying more interest charges overall than other debt repayment strategies.Overall, the debt snowball method is a simple and effective debt repayment strategy that can help individuals get out of debt faster.

However, it is important to weigh the benefits and disadvantages of the debt snowball method before deciding if it is the right strategy for you.

Advantages of the Debt Snowball Method

There are several advantages to using the debt snowball method, including:

- Can help build momentum and motivation by quickly paying off small debts.

- Can help individuals save money on interest charges by paying off debts with higher interest rates first.

- Is simple and easy to understand.

- Can help individuals stay on track with their debt repayment plan.

Disadvantages of the Debt Snowball Method

There are also some disadvantages to using the debt snowball method, including:

- Can take longer to pay off all debts than other debt repayment strategies, such as the debt avalanche method.

- Can result in paying more interest charges overall than other debt repayment strategies.

Identifying and Prioritizing Debts: The Debt Snowball Chapter 4 Lesson 6

Under the debt snowball method, it is crucial to identify and prioritize debts for effective repayment. This involves recognizing all outstanding debts, assessing their balances, interest rates, and minimum payments, and determining a strategic order in which to tackle them.

The key principle of the debt snowball method is to focus on paying off the smallest debt first, regardless of its interest rate. This approach provides psychological motivation and a sense of accomplishment as each debt is eliminated.

Organizing and Tracking Debts

To effectively manage and track debts for repayment, consider the following tips:

- Create a comprehensive list:Document all outstanding debts, including credit cards, loans, and any other obligations.

- Record essential details:For each debt, note the balance, interest rate, minimum payment, and due date.

- Utilize a budgeting app or spreadsheet:Track debt payments and monitor progress towards repayment goals.

- Review regularly:Periodically assess the list and make adjustments as debts are paid off or new ones arise.

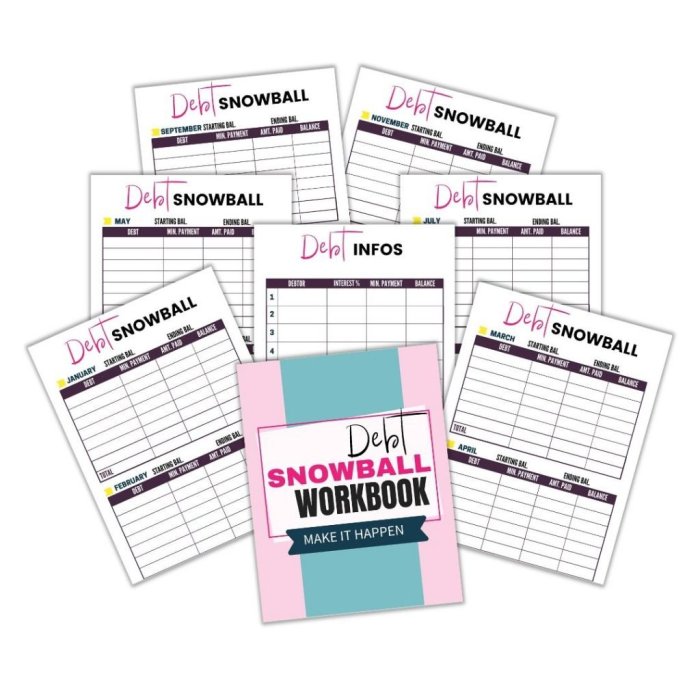

Creating a Debt Repayment Plan

The debt snowball method involves creating a structured plan for repaying your debts in a specific order. This plan should Artikel the steps you need to take, the amounts you need to pay, and the timelines for each payment.

To create a debt repayment plan based on the debt snowball method, follow these steps:

- List your debts:Create a list of all your debts, including the balance, interest rate, and minimum payment for each.

- Order your debts:Order your debts from smallest to largest balance, regardless of interest rate.

- Make minimum payments on all but the smallest debt:Allocate the minimum payments to all of your debts except for the smallest one.

- Put any extra money towards the smallest debt:Apply any extra funds you have available to the smallest debt until it is paid off.

- Repeat steps 3-4 until all debts are paid off:Once the smallest debt is paid off, move on to the next smallest debt and repeat steps 3-4 until all debts are paid off.

Sample Debt Repayment Plan Template, The debt snowball chapter 4 lesson 6

| Debt | Balance | Interest Rate | Minimum Payment | Extra Payment | Total Payment ||—|—|—|—|—|—|| Credit Card 1 | $1,000 | 18% | $25 | $100 | $125 || Credit Card 2 | $2,000 | 15% | $50 | $150 | $200 || Personal Loan | $5,000 | 10% | $100 | $200 | $300 || Student Loan | $10,000 | 6% | $150 | $250 | $400 |

This template provides an example of how to track your debts and payments as you work through the debt snowball method.

Importance of Budgeting and Extra Payments

Budgeting is essential for successful debt repayment. Creating a budget will help you track your income and expenses, identify areas where you can cut back, and allocate funds towards debt repayment.

Making extra payments towards debt reduction is crucial for accelerating the repayment process. Any additional funds you can apply to your debts will reduce the overall interest you pay and help you become debt-free faster.

Managing Cash Flow and Expenses

Effectively managing cash flow and expenses is crucial while using the debt snowball method. This involves creating a budget that tracks income and expenses, reducing unnecessary spending, and allocating funds towards debt repayment.

Reducing Expenses

- Identify non-essential expenses:Analyze spending habits to determine areas where expenses can be reduced, such as entertainment, dining out, or subscriptions.

- Negotiate bills:Contact service providers (e.g., phone, internet) to inquire about discounts or lower rates.

- Utilize coupons and discounts:Take advantage of coupons, discounts, and promo codes when making purchases.

- Consider generic brands:Opt for generic or store-brand products instead of name brands to save money.

Increasing Income

- Explore additional income streams:Consider part-time work, freelancing, or starting a side hustle to supplement income.

- Request a raise or promotion:If possible, approach your employer to discuss salary expectations based on performance and contributions.

- Sell unused items:Declutter and sell items that are no longer needed to generate extra income.

- Utilize tax refunds:Allocate tax refunds towards debt repayment instead of spending them.

Allocating Funds

Once expenses are reduced and income is increased, allocate funds towards debt repayment. Prioritize debts based on the snowball method, focusing on paying off the smallest balance first while making minimum payments on others.

Emergency Funds and Unexpected Expenses

Establish an emergency fund to cover unexpected expenses and avoid using debt as a safety net. If unexpected expenses arise, consider negotiating with creditors or exploring alternative payment arrangements to prevent debt accumulation.

Staying Motivated and Overcoming Challenges

Maintaining motivation and overcoming obstacles are crucial during the debt snowball process. Here are effective strategies and examples of successful individuals who have utilized this method.

Staying Motivated

- Set realistic goals:Avoid overwhelming yourself with ambitious repayment targets. Start with small, achievable goals to build momentum and avoid discouragement.

- Track progress:Regularly monitor your debt repayment and celebrate milestones. Visualizing your progress can boost motivation and keep you focused.

- Find a support system:Surround yourself with supportive friends, family, or a financial advisor who can provide encouragement and accountability.

Overcoming Challenges

Unexpected setbacks are inevitable during debt repayment. Here’s how to navigate them effectively:

- Anticipate challenges:Recognize that setbacks may occur and prepare for them mentally and financially.

- Re-evaluate your budget:If unexpected expenses arise, adjust your budget to prioritize debt repayment while minimizing non-essential spending.

- Seek professional help:If you struggle to overcome challenges on your own, consider seeking guidance from a financial counselor or credit counselor.

Success Stories

Numerous individuals have successfully used the debt snowball method to eliminate debt and improve their financial well-being:

- Dave Ramsey:Personal finance expert and author of “The Total Money Makeover,” Ramsey has helped millions of people achieve financial freedom through the debt snowball method.

- Melinda Murphy:A single mother, Murphy paid off over $100,000 in debt using the debt snowball method and documented her journey on her blog.

These success stories demonstrate that staying motivated and overcoming challenges during the debt snowball process is possible with determination and support.

Question & Answer Hub

What is the Debt Snowball Method?

The Debt Snowball Method is a debt repayment strategy that involves paying off your smallest debts first, regardless of their interest rates. This method helps you gain momentum and build motivation as you quickly eliminate your smaller debts.

How do I prioritize my debts using the Debt Snowball Method?

Prioritize your debts from smallest to largest, regardless of interest rates. This allows you to focus on making progress and building momentum, which can help you stay motivated and on track.

What are the advantages of using the Debt Snowball Method?

The Debt Snowball Method offers several advantages, including:

- Provides a sense of accomplishment and motivation as you quickly pay off small debts.

- Helps you build momentum and stay on track, even when faced with setbacks.

- Can help you reduce your overall debt burden and improve your credit score.