Prepare wells technical institute’s balance sheet as of december 31 – Unveiling the financial health of Prepare Wells Technical Institute, we delve into its Balance Sheet as of December 31, providing a comprehensive analysis of the Institute’s assets, liabilities, and equity, revealing insights into its financial stability, solvency, and liquidity.

The Balance Sheet presents a snapshot of the Institute’s financial position at a specific point in time, offering valuable information for stakeholders, investors, and decision-makers alike.

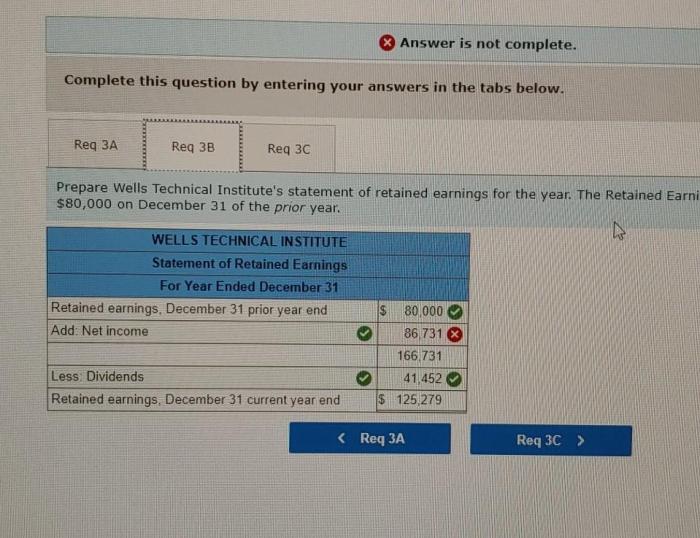

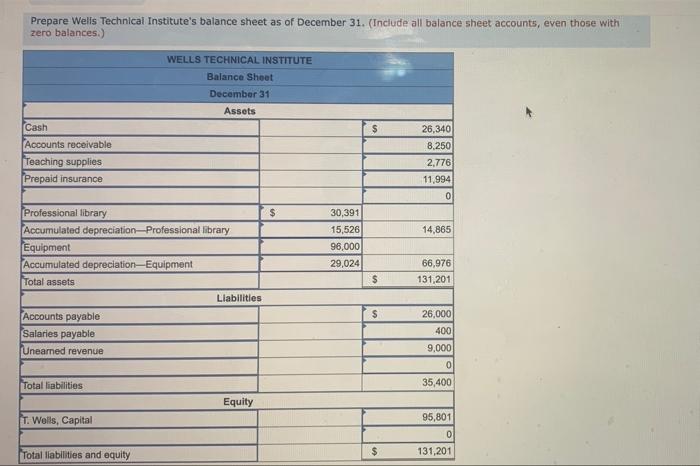

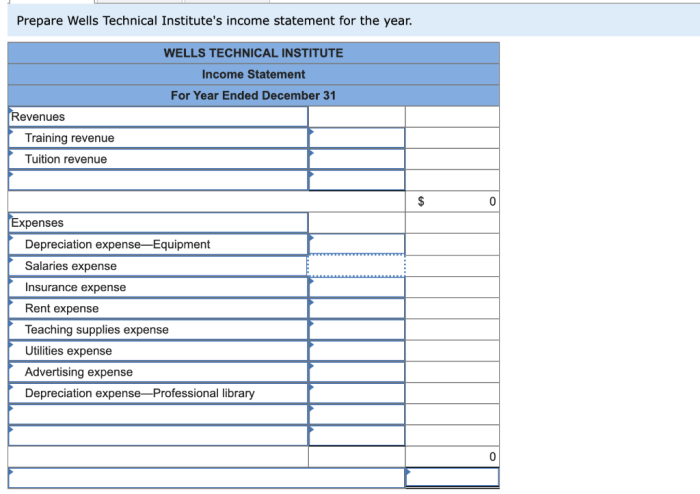

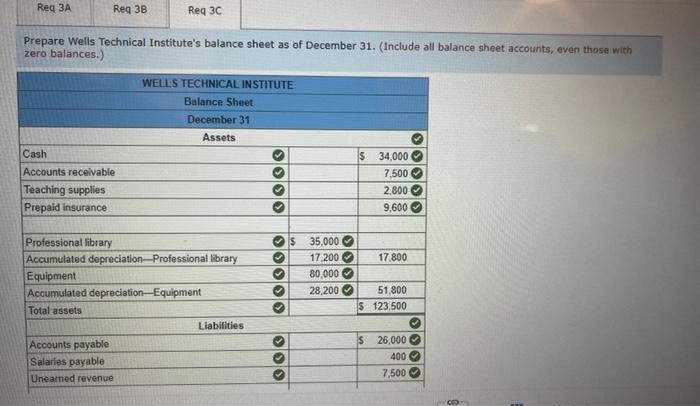

Balance Sheet of Prepare Wells Technical Institute: Prepare Wells Technical Institute’s Balance Sheet As Of December 31

The balance sheet of Prepare Wells Technical Institute provides a snapshot of the institute’s financial position at a specific point in time. It presents the institute’s assets, liabilities, and equity, providing insights into its financial health and stability.

Assets

The institute’s assets can be classified into current assets and non-current assets.

Current Assets

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Prepaid expenses

Non-Current Assets

- Property, plant, and equipment

- Intangible assets

- Investments

Liabilities

The institute’s liabilities can be classified into current liabilities and non-current liabilities.

Current Liabilities

- Accounts payable

- Accrued expenses

- Short-term debt

Non-Current Liabilities

- Long-term debt

- Deferred income taxes

- Other long-term obligations

Equity

The institute’s equity represents the residual interest in the assets after deducting liabilities. It includes:

- Share capital

- Retained earnings

- Other reserves

Financial Ratios, Prepare wells technical institute’s balance sheet as of december 31

Financial ratios can be used to assess the institute’s liquidity, solvency, and profitability. Key ratios include:

- Current ratio

- Debt-to-equity ratio

- Return on assets

Trends and Comparisons

Analyzing trends in the balance sheet over time can identify patterns and changes in the institute’s financial position. Comparing the institute’s financial ratios to industry benchmarks or similar institutions can assess its relative performance.

Quick FAQs

What are the key financial ratios used to assess the Institute’s performance?

The analysis includes the calculation of key financial ratios, such as liquidity ratios (current ratio, quick ratio), solvency ratios (debt-to-equity ratio, times interest earned ratio), and profitability ratios (gross profit margin, net profit margin), providing insights into the Institute’s financial stability, efficiency, and profitability.

How does the Institute’s financial performance compare to industry benchmarks?

The analysis compares the Institute’s financial ratios to industry benchmarks or similar institutions, allowing for an assessment of its relative performance and identification of areas for improvement.