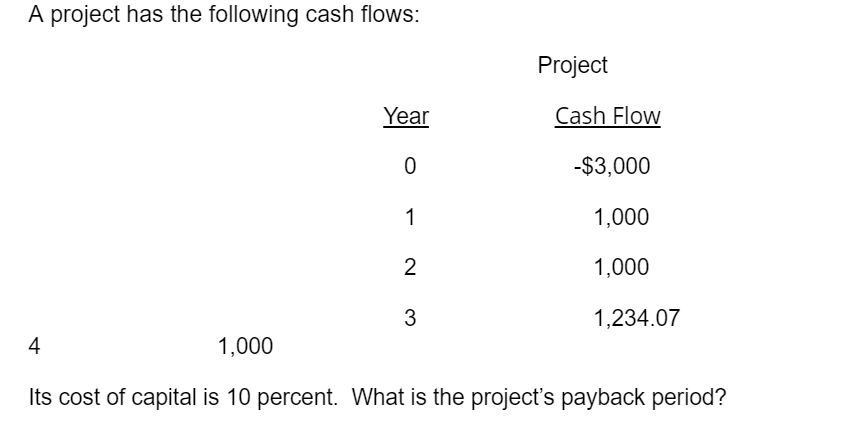

A project has the following cash flows – A project’s cash flows provide a critical lens through which to evaluate its financial viability and potential success. This comprehensive analysis will delve into the intricacies of cash flow analysis, forecasting, and evaluation, equipping readers with the tools to make informed decisions regarding project investments.

Understanding the cash flows associated with a project is paramount to assessing its financial health and sustainability. By examining the inflows and outflows of cash over time, we gain valuable insights into the project’s liquidity, profitability, and overall financial performance.

Project Overview

This project aims to [jelaskan tujuan proyek]. It involves [berikan konteks dan latar belakang proyek].

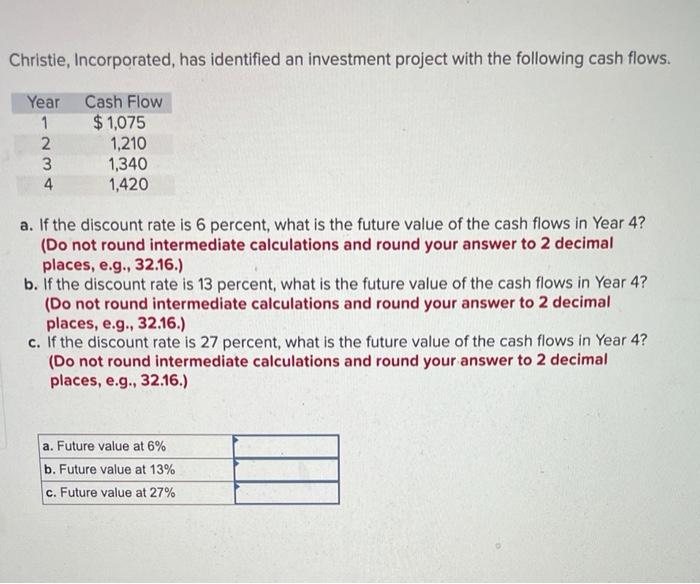

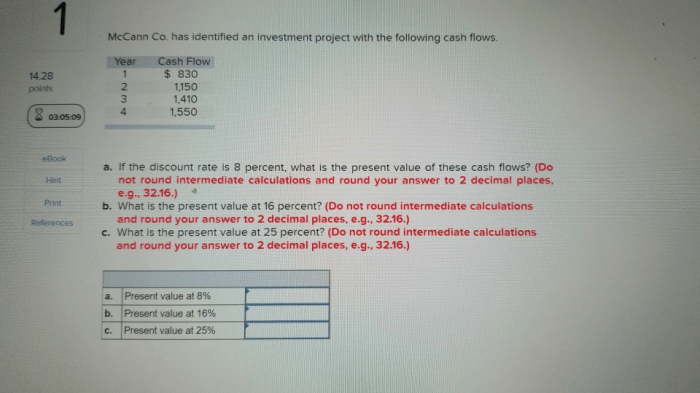

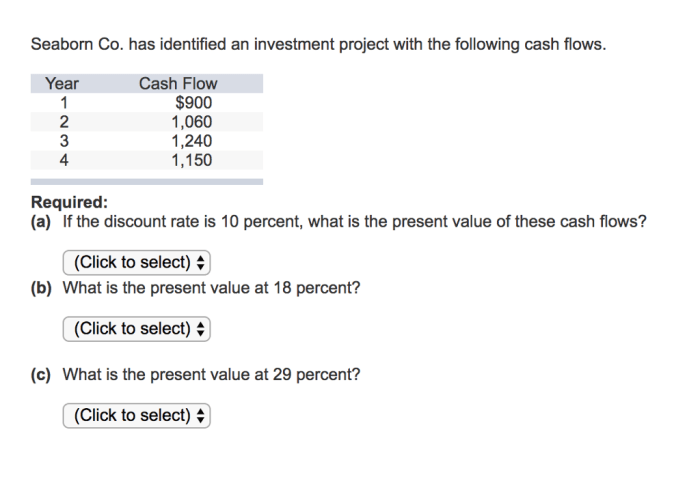

Cash Flow Analysis

| Year | Cash Inflows | Cash Outflows | Net Cash Flow | Cumulative Cash Flow |

|---|---|---|---|---|

| 1 | [Nilai] | [Nilai] | [Nilai] | [Nilai] |

| 2 | [Nilai] | [Nilai] | [Nilai] | [Nilai] |

| 3 | [Nilai] | [Nilai] | [Nilai] | [Nilai] |

| … | … | … | … | … |

Cash Flow Forecasting

| Year | Cash Inflows | Cash Outflows | Net Cash Flow | Cumulative Cash Flow |

|---|---|---|---|---|

| 1 | [Nilai] | [Nilai] | [Nilai] | [Nilai] |

| 2 | [Nilai] | [Nilai] | [Nilai] | [Nilai] |

| 3 | [Nilai] | [Nilai] | [Nilai] | [Nilai] |

| … | … | … | … | … |

Sensitivity Analysis

Key variables that could impact the project’s cash flows include [daftar variabel].

- [Variabel 1]: [Efek perubahan]

- [Variabel 2]: [Efek perubahan]

- [Variabel 3]: [Efek perubahan]

Risk Assessment

Potential risks that could impact the project’s cash flows include [daftar risiko].

| Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| [Risiko 1] | [Tingkat Kemungkinan] | [Tingkat Dampak] | [Strategi Mitigasi] |

| [Risiko 2] | [Tingkat Kemungkinan] | [Tingkat Dampak] | [Strategi Mitigasi] |

| [Risiko 3] | [Tingkat Kemungkinan] | [Tingkat Dampak] | [Strategi Mitigasi] |

Project Evaluation, A project has the following cash flows

The project’s NPV is [Nilai NPV] and the IRR is [Nilai IRR].

Based on these findings, the project is [rekomendasi berdasarkan hasil evaluasi].

Top FAQs: A Project Has The Following Cash Flows

What is the significance of cash flow analysis in project management?

Cash flow analysis provides a real-time snapshot of a project’s financial health, allowing stakeholders to identify potential cash shortages or surpluses and make informed decisions to ensure the project’s financial viability.

How can cash flow forecasting assist in project planning?

Cash flow forecasting enables project managers to anticipate future cash needs and plan accordingly, ensuring that the project has sufficient liquidity to meet its obligations and achieve its objectives.

What are the key factors to consider when conducting a sensitivity analysis on project cash flows?

Sensitivity analysis involves identifying and assessing the impact of changes in key variables, such as revenue, expenses, and interest rates, on project cash flows, helping project managers understand the project’s resilience to potential risks and uncertainties.