A thief steals an ATM card, a crime that can have devastating consequences for the victim. This article will explore the methods thieves use to steal ATM cards, the impact of ATM card theft on victims, and tips for preventing this type of crime.

ATM card theft is a serious problem, and it’s important to be aware of the risks and take steps to protect yourself.

Theft of an ATM Card

ATM card theft involves the unauthorized acquisition of an individual’s ATM card, typically with the intent of accessing their financial accounts.

Thieves employ various methods to steal ATM cards, including:

- Shoulder surfing:Observing an unsuspecting victim entering their PIN at an ATM or point-of-sale terminal.

- Skimming:Using a device attached to an ATM card reader to capture the card’s magnetic stripe data.

- Card trapping:Inserting a foreign object into an ATM card slot to trap the victim’s card.

- Phishing:Sending fraudulent emails or text messages that trick victims into revealing their ATM card information.

Once a thief has obtained an ATM card, they may also attempt to acquire the associated PIN. This can be done through social engineering techniques, such as pretending to be a bank employee or asking the victim for help with their ATM transaction.

The consequences of ATM card theft can be severe for the victim. They may lose access to their funds, incur unauthorized charges, and face identity theft.

Methods of ATM Card Theft: A Thief Steals An Atm Card

Thieves employ various sophisticated techniques to steal ATM cards, including skimming devices, card trapping, and shoulder surfing.

Skimming Devices

Skimming devices are electronic devices that capture ATM card information when inserted into an ATM. These devices are often attached to the ATM’s card reader or keypad and can record the card’s magnetic stripe data or PIN.

Card Trapping

Card trapping involves placing a device inside the ATM’s card slot to prevent the card from being ejected after use. When the victim leaves the ATM, the thief retrieves the card, often using a hidden camera to record the victim’s PIN.

Shoulder Surfing

Shoulder surfing is a technique where thieves observe victims entering their PIN at an ATM. They may stand close to the victim or use binoculars or other devices to obtain the PIN.

A thief who stole an ATM card might be a “legal alien,” as described in the poem legal alien by Pat Mora . This poem explores the complex emotions and experiences of immigrants in the United States, highlighting the challenges they face in navigating a foreign land while longing for their homeland.

The thief’s act of stealing an ATM card may symbolize their desperation or their attempt to survive in an unfamiliar environment.

Prevention of ATM Card Theft

ATM card theft is a serious crime that can lead to financial loss and identity theft. There are several steps you can take to protect yourself from becoming a victim of ATM card theft.

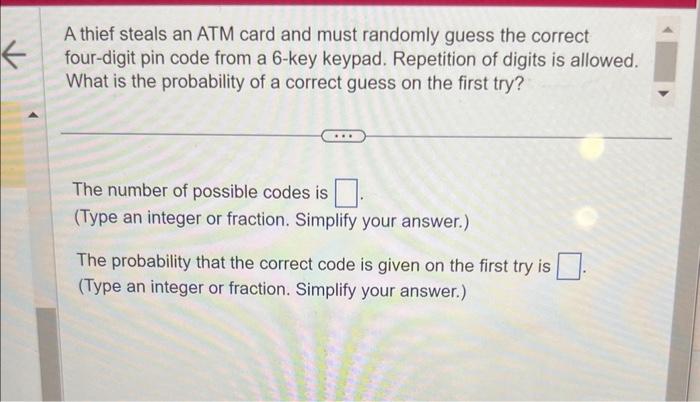

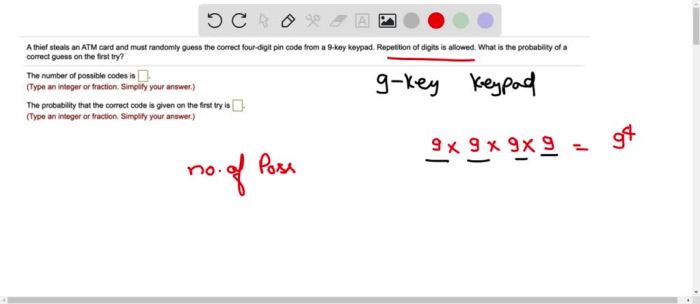

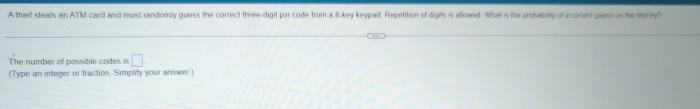

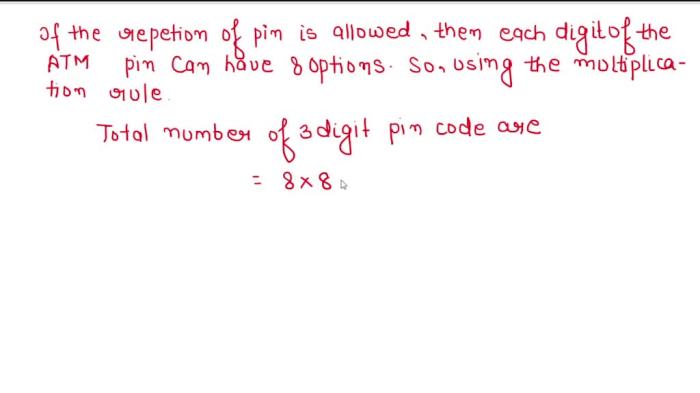

Using Secure PINs

One of the most important things you can do to protect your ATM card is to use a secure PIN. Your PIN should be at least four digits long and should not be easily guessed, such as your birthdate or phone number.

You should also memorize your PIN and never write it down or share it with anyone.

Being Aware of Surroundings

When using an ATM, be aware of your surroundings. If you notice anything suspicious, such as someone loitering nearby or trying to distract you, cancel your transaction and leave the ATM.

Banks’ Role in Prevention

Banks play a role in preventing ATM card theft by implementing security measures such as chip-and-PIN technology and fraud monitoring systems. Chip-and-PIN technology makes it more difficult for thieves to counterfeit cards, and fraud monitoring systems can help banks identify and stop fraudulent transactions.

Impact of ATM Card Theft on Victims

The theft of an ATM card can have severe consequences for victims, both financially and emotionally.

Financially, victims may lose the funds in their bank account, as well as any overdraft fees or other charges incurred by the thief. They may also be liable for any fraudulent transactions made using their card before it was reported stolen.

Emotionally, victims of ATM card theft may feel violated and betrayed. They may also worry about their financial security and the possibility of identity theft.

Steps Victims Should Take to Mitigate the Damage

If your ATM card is stolen, it is important to take the following steps to mitigate the damage:

- Report the theft to your bank immediately.

- Cancel your card and request a new one.

- Monitor your bank account for any unauthorized transactions.

- File a police report.

Legal Implications of ATM Card Theft, A thief steals an atm card

ATM card theft is a crime in most jurisdictions. The penalties for perpetrators vary depending on the severity of the crime and the jurisdiction in which it occurs.

In some cases, ATM card theft may be considered a felony, punishable by imprisonment and/or fines.

Helpful Answers

What should I do if my ATM card is stolen?

If your ATM card is stolen, you should immediately contact your bank and cancel the card. You should also file a police report.

How can I protect myself from ATM card theft?

There are a number of things you can do to protect yourself from ATM card theft, including using strong passwords, being aware of your surroundings, and using ATMs in well-lit areas.